THE global macroeconomic picture is still more sluggish than investors would have liked, particularly when viewed from the gross domestic product (GDP) growth perspective for the first half of 2023 (1H23), although it remains a stretch to say the world is heading for a recession.

A quick glance across the Causeway to Singapore sees the city-state registering a 0.5% yearon-year (y-o-y) growth rate for the second quarter of the year (2Q23), extending marginally from the 0.4% expansion it charted for the preceding quarter.

Elsewhere, such as in major markets like the United States, China and the eurozone, economists are of the opinion that growth has been sturdy during 1H23 but stiff hurdles still remain on the horizon.

While acknowledging that global GDP growth has been slower so far in 2023 due to several familiar factors such as higher interest rates and elevated cost pressures, newly appointed Bank Negara governor Datuk Abdul Rasheed Ghaffour is also not expecting the global economy to slip into recession.

He says resilient domestic demand in advanced economies is providing sufficient support, while also anticipating worldwide trade to improve towards the end of 2023.

Most notably, he perceives China’s slower-than-expected recovery to have limited impact on Malaysia’s own economic expansion and improvement.

“Malaysia’s economy is well diversified in terms of products, services and trade partners, which would cushion the Chinese impact,” says Abdul Rasheed.

According to Bernard Aw, chief economist at Singapore’s Coface Services South Asia-pacific Pte Ltd, although the global economy has been resilient year-to-date, growth outlook in the second half remains challenging, not the least from increasing signals of weakening Chinese economic activity.

Forecasting global GDP expansion to be at 2.2% y-o-y for 2023, and anticipating a similar growth rate of 2.3% growth for next year, he says: “We expect Asean GDP growth (2023: 4.3%; 2024: 4.6%) to be generally faster than advanced economies – at 4.3% and 4.6% for 2023 and 2024 respectively – as tourism recovery and domestic demand drives economic activity.”

Continuing subdued external demand for the region would imply that domestic demand has to continue to partially offset some of the slack, Aw, tells Starbizweek.

“However, the challenging economic environment worldwide, relatively high inflation and interest rates means that even growth in domestic consumption and investment may fall short of expectations,” Aw opines.

Commenting on the overall global interest rate environment, he believes that the trend of disinflation would continue into 2H23, mainly driven by lower energy prices, coupled with China’s deflation having fed into lower export prices, which has also moderated global price pressures.

On the flipside, Aw thinks underlying inflation will remain fairly sticky, despite not being severe enough necessarily for central banks to revert to hiking rates.

“Having said that, they will likely maintain the current restrictive interest rates for a longer-than-expected period,” he says.

Earlier in July, it was reported that the United States economy had grown 2.4% y-o-y in 2Q23, up from the 2% it posted for the first three months of the year and bringing 1H23 GDP to a commendable 2.2%.

“The improved expansion rate had been driven by consumer spending, on top of increases in non-residential fixed investment, government spending and inventory growth.

At the same time, China had registered a 6.3% 2Q23 y-o-y GDP growth rate, which was also an improvement from the 4.5% charted in the previous quarter.

The acceleration however was slower than the expected 7.3% forecast by economists on a Reuters poll, dragged back by tepid demand and sinking property prices which has sapped consumer confidence.

On the same note, chief executive of Centre for Market Education Carmelo Ferlito feels that China’s post “zero-covid” recovery has been fragile since the beginning.

“The economy is not an engine to be switched on and off, but rather it is a living emergent order.

“As such, China is paying the price to a degree with its severe, nation-wide lockdowns while it was implementing the zero-covid policy,” he says.

The decelerating growth in China, says Ferlito, is evidenced by the People’s Bank of China unexpectedly cutting a range of key interest rates on Tuesday, which is seen as an emergency move to reignite growth after new data showed the economy has decelerated further last month.

With Chinese officials from its National Bureau of Statistics also suspending reports on youth unemployment, he says the move would deprive investors, economists and businesses of another key data point on the declining health of the world’s second-largest economy.

Divulging more numbers, Ferlito says the twin moves of cutting rates and holding back unemployment data from the Chinese government has coincided with new data showing a slowdown in spending growth by consumers and businesses.

“Concurrently, factory output grew much less than expected, adding to a recent raft of worrying signals. For the first time since February, China’s headline measure of unemployment rose, climbing to 5.3%.

“The jobless rate for people ages 16 to 24, meanwhile, had marched steadily higher for six consecutive months to hit a series of record highs, culminating in a reading of 21.3% in June,” he says.

Ferlito says an economic trichotomy is emerging on the global scene, before adding: “The United States is still fighting inflation, but countries like Germany and Holland are starting to experience technical recession, while China is facing challenges of its own.

“It is that post-lockdown crisis that the CME predicted two years ago.”

Echoing Bank Negara governor Abdul Rasheed, he re-emphasises that it is important to look beyond GDP figures, making his case that if the GDP of a country declines because of a cut in impractical government spending, that would be positive for a country.

Conversely, he argues if GDP growth were to accelerate due to an increase in spending financed by debt, it ultimately would be a bane to the government’s coffers and the national economy.

Meanwhile, the International Monetary Fund (IMF) is predicting a 3% GDP global growth rate for this year and the next, receding from the 3.5% achieved in 2022.

It says the rise in central bank policy rates to stave off inflation has continued to weigh on economic activity, but the good news is that global headline inflation is expected to fall from 8.7% last year to 6.8% in 2023 and 5.2% in 2024.

“The recent resolution of the US debt ceiling stand-off and strong action by authorities to contain turbulence in the US and Swiss banking earlier this year reduced the immediate risks of financial sector turmoil. This moderated adverse risks to the outlook,” the IMF says.

However, it cautions that the balance of risks to global growth remains tilted to the downside, as inflation could remain high and even rise if further shocks occur, including those from an escalation of the Russia-ukraine conflict.

Moreover, the IMF warns that China’s recovery could slow further, partly due to unresolved real estate problems, with negative cross-border spillovers.

On the upside, inflation could fall faster than expected, reducing the need for tight monetary policy, and domestic demand could again prove more resilient

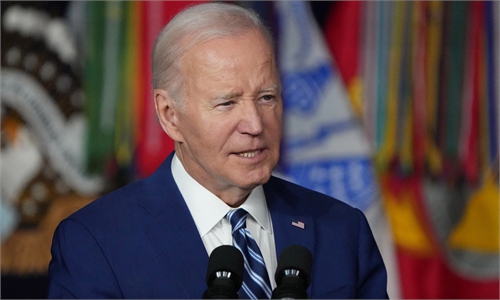

As the election campaign progresses, Washington's bottom line will sink lower and lower, and more sensational claims are likely to come out. The unscrupulous smearing and attacking of China has made the US nastier and nastier.

| SINGAPOREThe 10 charged afThe 10 charged after billion-dollar anti-money laundering … |

Who are the 10 charged after the billion-dollar anti-money …

No comments:

Post a Comment