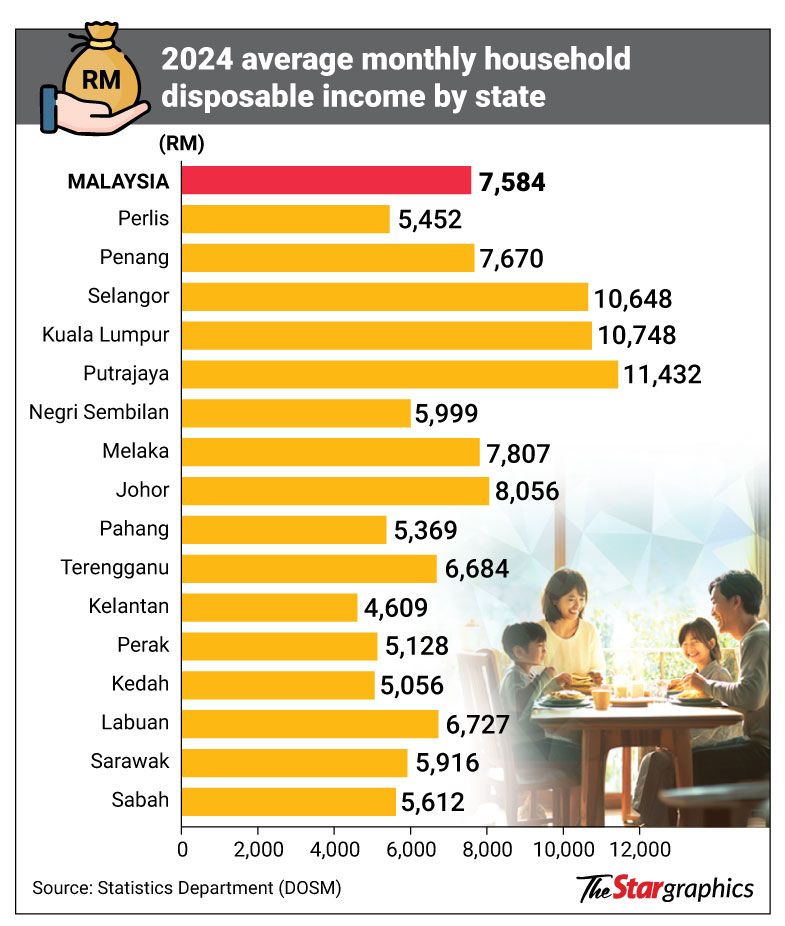

PUTRAJAYA: Malaysia’s average disposable household income rose by 3.2% to RM7,584 in 2024, according to the latest Household Income and Expenditure Survey (HIES) 2024 Report.

“In terms of disposable income, the average monthly disposable household income increased by 3.2% to RM7,584 in 2024, while the median rose 5.1% to RM5,999. This represents 82.8% of total gross household income, indicating households’ ability to meet essential expenditure needs,” the report stated.

The report also highlighted that this rise in disposable income was accompanied by a gradual improvement in income distribution.

“Households in the Bottom 40 (B40) group, comprising 3.28 million households, had income of up to RM5,858,” according to the report, which was released yesterday.

The report comprises 33 official statistical publications, presenting comprehensive findings and analyses of the country’s socioeconomic landscape from the perspective of household income and expenditure.

It also noted that the median household income in Malaysia reached RM7,017 in 2024, growing by 5.1% annually, while the mean household income rose by 3.8% to RM9,155.

Income growth varied by state, reflecting diverse economic conditions, the report added.

Six states recorded median household incomes above the national level, with Kuala Lumpur at RM10,802, followed by Putrajaya (RM10,769), Selangor (RM10,726), Johor (RM7,712), Penang (RM7,386) and Labuan (RM7,383).

“Penang recorded the highest annual growth rate at 6.4% between 2022 and 2024,” the report stated.

The report also noted that the B40 group’s share of total national income rose slightly to 16.7%, up from 16.3% in 2022.

In contrast, the Top 20% (T20), who earned RM12,680 and above per month, saw their share decline to 45.1%, down from 46.3%. The Middle 40% (M40), earning between RM5,860 and RM12,679, made up a significant portion of the remaining income share.

At the event, Economy Minister Datuk Seri Amir Hamzah Azizan described HIES in his keynote address as a vital statistical instrument for measuring progress and improving the socio-economic status of Malaysian households.

“It is one of the main sources for shaping the country’s socio-economic and social policies, including poverty eradication programmes, increasing income, reducing income inequality, and addressing the cost of living,” he explained.

Amir Hamzah added that Malaysia has achieved a major milestone, with hardcore poverty nearly eradicated and reduced to just 0.09%.

“This reflects the effectiveness of various initiatives to increase people’s income, empower urban communities economically, and enhance public well-being, all of which will be continued by the government,” he said.

The Gini coefficient improved to 0.390 in 2024, compared to 0.404 in 2022, signalling a narrowing of income inequality.

The national absolute poverty incidence decreased from 6.2% in 2022 to 5.1% in 2024, representing about 416,000 households.

“Poverty in urban areas declined to 3.7%, while poverty in rural areas improved to 12%,” the report noted.

“The hardcore poverty incidence dropped to 0.09%, equivalent to fewer than 8,000 households earning below the Food Poverty Line Income (PLI),” it added